While this may remind you of your high school guidance counselor, our real intention is to remind you that there has never been a better time to answer this question, especially with a shift in the economy and a tug-of-war in health legislation.

Fortunately, we’ve done our homework and have seen how doctors have protected their financial security in the past. This gives us a clear insight into what the right path is towards the future you and your family deserve.

First, close your eyes for ten seconds and paint a picture of that future.

What did you see?

- A different home (maybe a vacation home)?

- Nice getaways?

- Large savings?

- Kids, grandkids in college?

Getting to that happy place takes planning; planning that is usually put aside to tend to more pressing matters, such as running your own practice and keeping up with your patient stream. No wonder many doctors can’t find the time nor the place to begin planning their finances.

You don’t know what you don’t know.

If finances, taxes or insurance are not up your alley, that’s OK. Recognizing that you can’t afford to go about it alone is definitely the right way to kick things off. There are many financial advisors that can help you set a plan into motion, which brings us to step number one.

1. Talk to a financial advisor

How frustrated are you when you have to tell a patient “why didn’t you come see me sooner?” Financial advisors get that same feeling.

Your financial advisor will help maximize your financial position over your work life through retirement; they will be able to pinpoint where you should diversify your savings, gauge the risks you may be exposed to, as well as look into other issues you may be susceptible to. For instance, many physicians saving for their children’s education have paid thousands more in taxes than they should have—let that sink in—, only to realize that they could have doubled the tax deductions they’re taking on 529 college savings plans. Don’t believe us? Ask your financial advisor.

Keep in mind, you don’t have to go with the first advisor you meet. Many physicians choose their advisors based on a friend’s recommendation. This is certainly a good start, but consider that every person has different goals, risk tolerances, family size, etc. You should focus on finding an advisor that you can establish a long-term relationship with and that can suit your specific needs. This takes research and perhaps a few face to face meetings, but hang in there, your ideal financial advisor is out there.

2. Don’t make decisions based on market news

Buying the “hot stock of the day” can seem tempting, but let’s face it, by the time it hits teleprompters, you’ll be paying more than its worth. We’re not saying you shouldn’t invest in stocks; on the contrary, owning equity can be a great way of diversifying your portfolio and seeing some nice returns.

Remember, just like any other investment, stocks come with risks. So, you may need to develop a strong stomach to maintain and grow your financial position. Otherwise, you can adjust your compass towards more conservative approaches.

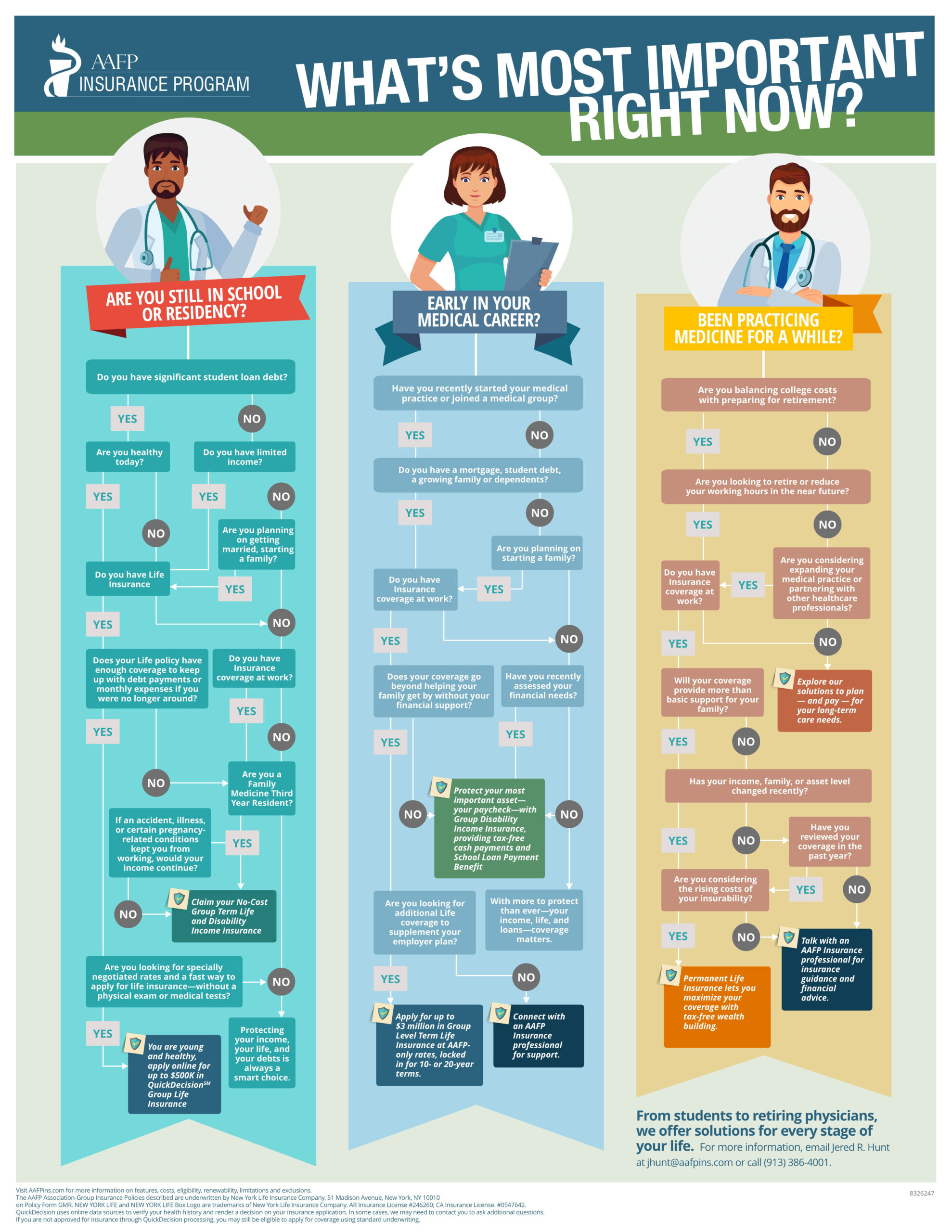

3. Make sure your life insurance is up to date

This might as well be the foundation of your family’s financial health over time. Having a life insurance plan that you can adjust to your finances as they change over time will give you the peace of mind you need to continue building your estate. This is fundamental at every stage of your life and the longer you have it, the better off you’ll be.

Also remember that if you work for an employer, the coverage you have is only temporary; not to mention you can be subject to cookie-cutter policies that might not benefit you and your family as much in the long run, whereas other plans, such as AAFP’s Level Premium Term Life Insurance are designed to follow you to any job you choose, offering up to $2,000,000 in benefits at exclusive member rates that are locked in for 10 or 20 years. Plus, you can use it as your main source of life insurance or as a supplement to any other coverage you have.

4. Involve your spouse

Think about it, the financial planning decisions you make today will surely have an impact on you and your spouse (and children) over time. Start by creating budgets; this way you can control overspending habits in the family. You and your spouse can determine how much you’d like to have during retirement and allocate funds to long-term savings based on that, or how much you want to set aside for short-term savings, student loans, rent, etc.

Most importantly: your will. If you are married or have children, or both, you’ll want your loved ones to receive tax advantages when you pass down your assets, all while avoiding complications. It is important that it remains up-to-date so your affairs are in order.

5. Understand how to withdraw your savings during retirement

Last but not least, what happens when you reach retirement? You’ve worked your entire life planning for this moment, so it’s crucial that you understand how your funds work. Having a financial advisor on your side can help you determine what are the most efficient ways of accessing your funds during this time period.

By getting this far, you’ve already started taking action! So, here’s your homework for the week—it’s very simple.

- Along with your spouse, write down the three main goals you’d like to achieve by retirement age

- Set out a time to share them with your financial advisor

If you or your colleagues have had experience with financial advisors: tell us, how long have you been using their services and how have they impacted your finances so far?