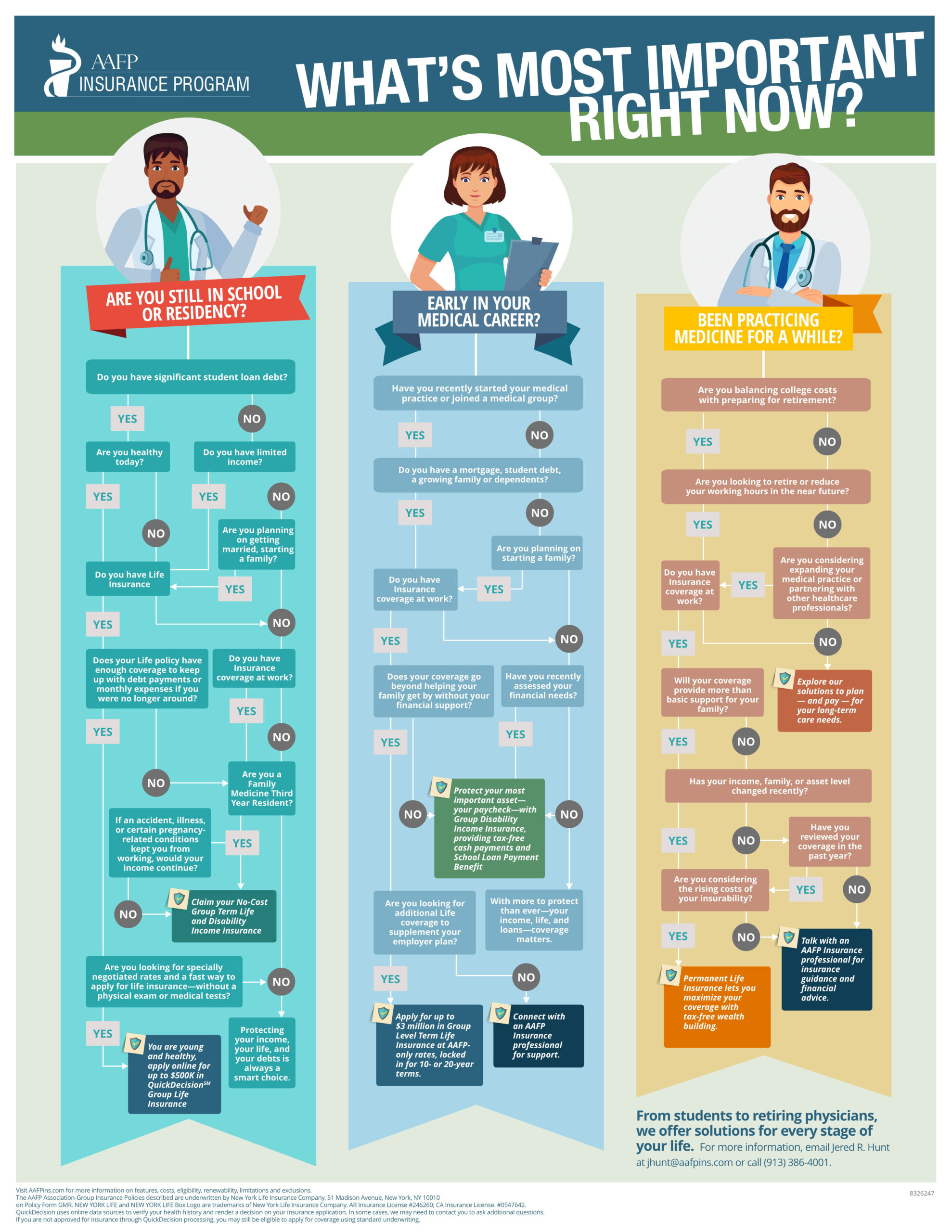

Your ability to work and earn a steady income is your greatest asset, and if you don’t protect it, you could find yourself in financial ruin. If you were to become disabled and unable to treat your patients for an extended period of time, how would you be able to provide for yourself?

When most young professionals enter the workforce, purchasing a disability insurance policy is the last thing on their mind. It’s one of the most overlooked types of insurance which is unfortunate as 1 in 4 of today’s 20 year olds will become disabled before they are ready to retire. While some employers offer disability income insurance, it may not be enough to cover all of your needs. In addition, signing up for a policy is optional, which is why many people don’t bother to have it. According to The Hartford Financial Services Group, less than half of Millennials (those born in the early 1980s to the early 2000s) have signed up for disability insurance. And if you’re still paying off student loans, a serious injury or illness could put you in deeper financial debt.

The biggest misconception about disability insurance is that it’s too expensive. When calculating the cost of disability coverage, expect to pay about 1 – 3% of your annual income, but keep in mind you may have to pay more depending on a variety of personal, professional and underwriting factors. Disability income insurance is one of the best ways for family physicians to protect themselves from unexpected illness, accidents or other problems that prevent them from practicing medicine. Remember this – the real worry is the cost of not having it.

In addition to disability insurance, life insurance is another form of financial protection that shouldn’t go overlooked and is more affordable than you think. While you may still be in your prime as a young family physician, you should prepare for anything that lies ahead. When a family suffers the loss of a breadwinner, they may fall on hard times trying to pay off any outstanding debt that was left behind. According to the Association of American Medical Colleges, the average medical school debt for the class of 2013 was $169,901 and 79% of indebted graduates owe at least $100,000. In addition, 86% of all graduating medical students carry some type of outstanding loan. A life insurance policy will help prevent your family from having to carry this financial burden.

LIMRA and Life Happens released their annual “Insurance Barometer Study” which polled 2,047 U.S. adults age 18-75. The research revealed that 27% of Millennials are concerned about burdening others with final expenses. The survey also found that one of the greatest concerns for consumers under age 25 was leaving dependents in a difficult situation if they were to die prematurely (38%). In addition, 65% of consumers agree that they personally need life insurance and 27 % believe they need more. Cost was the main reason respondents didn’t purchase more life insurance with 63% saying it was too expensive.

This study reveals an extreme lack of awareness about the true cost of life insurance – a misconception that hasn’t changed in recent years. In fact, more than 80% of Americans surveyed overestimate the cost of life insurance. When respondents were asked the price for a $250,000 level-term life insurance policy for a healthy 30-year-old, the estimate given was $1,000 — that’s nearly 10 times the actual cost of $150 a year. The first step in debunking this myth is through education and awareness. Be sure to do your research to find the life insurance product that best fits your needs and consider the financial consequences if you forgo purchasing a policy.

We can’t predict the future, but we can prepare for it. Make sure that you take the necessary steps to protect your career and financial future with disability income insurance and life insurance offered by the AAFP Insurance Program.