Do you have a financial emergency fund put aside?

Do you have a financial emergency fund put aside?

Many physicians don’t. They often think that they’re too busy to focus on their financial situation. Or they’re making enough money so that they don’t have to worry about keeping to a budget. And they believe that their jobs are secure. That’s not surprising given that physicians and surgeons are among the top five professions with the greatest job security.

But perhaps the recent coronavirus outbreak and the shutdown that has thrown more than six million people into the ranks of the unemployed has you thinking twice. Many family physicians are experiencing financial challenges as patients cut back on routine visits. Research shows that outpatient visits fell by almost 60 percent from the beginning to the end of March.

The first step to amassing money for a rainy day is to calculate how much you’ll need. To live comfortably through the unexpected twists and turns of life, you should have an emergency fund that will cover you from three months to a year. Add up your monthly expenditures. Then set a goal for when you want your emergency account to be fully funded. You might decide, for example, that within the next six months you need to put aside enough money to cover the essentials for three months.

You can do this without scrimping and cutting corners. Here’s how.

1. Triage Your Spending Budget

The late Illinois Senator Everett Dirksen once said of the government, “A billion here, a billion there, and pretty soon you’re talking about real money.”

Well, minus the billions, it’s the same with your everyday spending. That’s why budgeting your money can be one of the smarter ways not only to manage your money but also to put something aside for that inevitable rainy day.

Start by making a complete (and honest) list of all your monthly expenditures, including those occasional indulgences in double decaf soy lattes. When you write it all down, you may discover that those “occasional indulgences” are more like routine habits.

Once you have your list, perform a triage. Prioritize your spending, cut out a few extras and commit to saving a minimum amount each month. Pretty quickly, a dollar here and a dollar there will add up to a real rainy day fund.

But we’re only just getting started.

2. Create a Payday Savings Plan

When it comes to saving money, the biggest hurdle is committing to the plan and sticking with it month after month and year after year. It’s so easy to say, “Well, I’ll spend a little extra now and put aside twice as much next month.” The truth is, we seldom do.

What’s more, just as with dieting, once you break the routine, it becomes easier to cheat going forward.

What you need is a regular occasion that automatically triggers your savings plan. A payday is an obvious event. It happens at least once a month, and you have money on hand. Based on your budgetary needs, select the amount you want to save, and then talk with your bank about setting up an Automatic Savings Plan.

3. Prioritize Paying Off Your Debts and Loans

When we think about saving for a rainy day, we usually focus on how to put aside a little income every month. But you can save even more if you pay off your debts and loans.

The place to start is with paying off your highest interest obligations first — often your credit cards. Once you have your credit cards under control, start paring down your next highest interest loan and so on.

As your monthly interest plus principal payments shrink, put that extra money into your emergency fund.

4. Keep Your Rainy Day Investments Liquid

The key to an emergency fund is to have the money available when you need it. When facing a financial emergency, you usually can’t wait for a bond to mature or a stock to move back into positive territory before selling.

Keep your money safe and liquid. Options to consider include the following:

- Money market account

- High-yield savings account

- Rewards checking account

- Certificates of deposit

- Short-term bond funds

While all of these are relatively liquid options, they do vary. Some pay a bit more interest, and a few have maturity dates. As your emergency nest egg begins to grow, consider diversifying your savings into several different types of accounts.

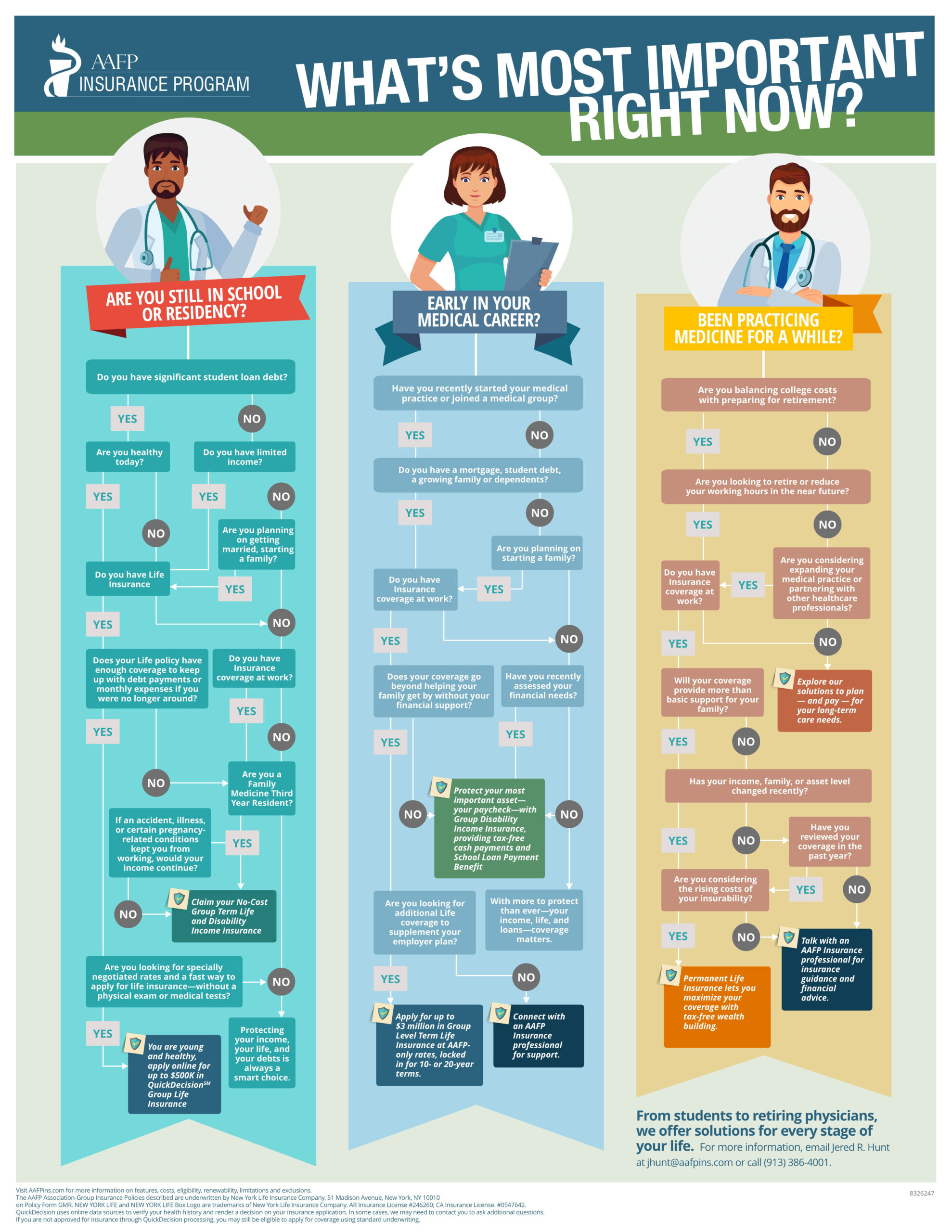

5. Insure Against Financial Risks

Another way to safeguard your growing emergency fund is to limit the need to dip into it. One way is to use insurance to protect against emergencies. In other words, you can avoid unnecessary financial risks by investing in home, health, auto, disability and life insurance.

Talk with an independent agent about your insurance needs and let them present the best options among several carriers. And when you place all your insurance with one agency, you’ll usually receive a discount. That’s more money saved and a big financial worry eliminated!

6. Chip Away at Those Student Loans As Quickly As Possible

Student loan debt is a burden most physicians have when starting their careers, and some continue to carry that debt well into midlife. But the faster you can pay off your student loans, the sooner you’ll be out from under a massive obligation.

First, be sure to include your student loans when prioritizing your financial obligations and looking to pay off the debts with the highest interest rates. Second, talk with your bank about ways to consolidate your student debt and maybe find a lower interest rate.

Between college and medical school, doctors can easily end up with a six-figure debt burden. So you’ll want to consider all your options for cutting this obligation down to size.

7. Put Lump Sums Into Savings

Commit to putting any lump sums into savings. Hold off on that new car, sailboat or computer, and make any tax refunds and bonuses part of your rainy day fund.

Be prepared for whatever the future brings. You can get started today by analyzing your budget, creating payday and lump sum savings plans, prioritizing and paying off your debts, insuring against risks, and finding the most efficient ways to pay off your student loans. Then keep your money safe and liquid.