After years of sacrifice and hard work, the arrival of your first paycheck as a physician is a defining moment that could shape your personal finances for years to come. You have a choice. You can immediately upgrade your lifestyle … or you can start paying off your student loans at a fast pace.

While the temptation to spend has never been greater, paying down your debts is the wiser course of action. Over time, the demands of your lifestyle will only become greater. You may want to move to a bigger home in a new neighborhood or buy the vacation home you’ve long considered. As your family grows, you’ll have added expenses that will probably include college savings funds.

While no one can deny you’re entitled to all you’ve earned, your long-term financial security will benefit if you don’t get too comfortable too quickly. Pay off your student debt first.

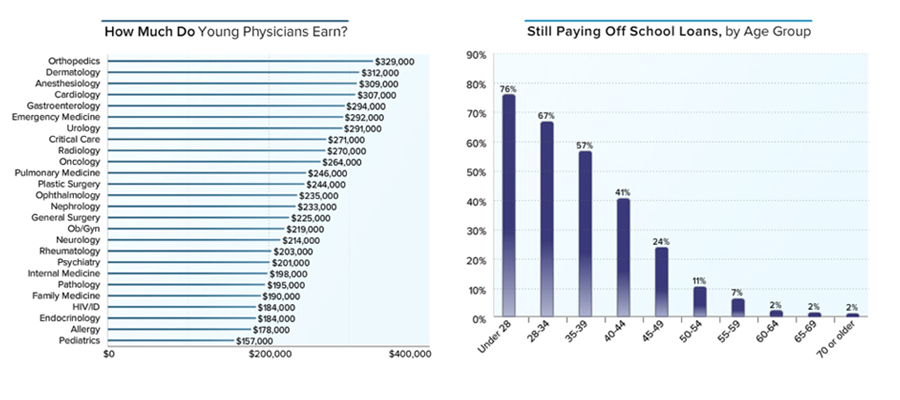

Start with 5 Ways to Conquer Medical School Debt. To get a better perspective on the subject, look at the charts below:

Source: Medscape

Family first

If anyone depends on you, you need to make sure they’ll be taken care of, no matter what. You can do that with life insurance. This protection can guarantee your family will continue to live the life you want for them, even if you are no longer here to provide it.

Seven in ten households say they’d have trouble keeping up with basic living expenses several months after the death of the family breadwinner.3 If your family would have trouble making ends meet, consider the exclusive life insurance for AAFP members. Up to $2,000,000 in benefits are available with the AAFP Association Group Guaranteed-Level-Premium Term Life Insurance plan.

Don’t DIY

Few careers are as demanding as those in medicine. Physicians spend long days with patients and countless hours keeping abreast of changes in their chosen field. That often leaves you with little extra time to spend with family, let alone to research market trends and manage your finances.

That may not be a concern when your earning potential is at its peak, but it may be an issue in retirement. Without significant savings, it may be difficult to maintain your lifestyle once you stop working. If you don’t have a financial advisor, it’s time to get one. In the meantime, we recommend 5 Ways Family Physicians Can Improve Their Financial Security. You work too hard not to make the most of your earnings.

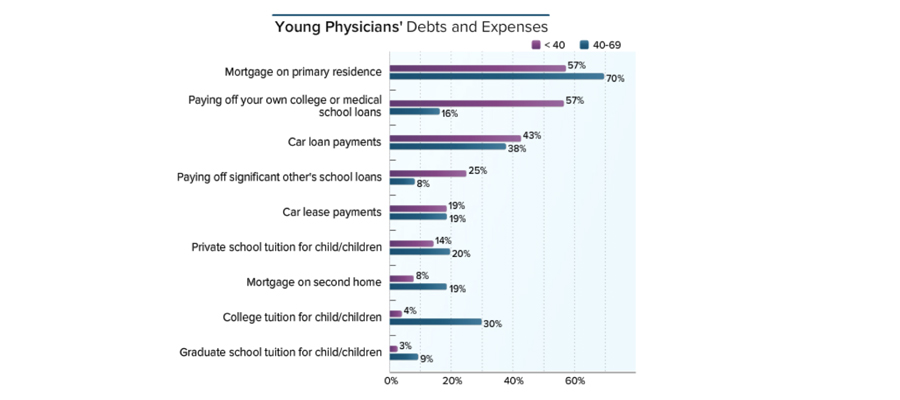

Source: Medscape

Stick to the budget

How much do you spend every month?

If it takes you a while to answer the question, you may be falling into the trap of improvisation, the kind of behavior that definitely can hurt your financial future.

It’s important to know not just how much you spend … but where you spend it. Take a good look at your expenditures in every category, from groceries and entertainment to insurance and savings.

Once you see where your money goes, set goals. That could be hitting a certain mark in your savings account … or reducing your overall debt by a predetermined amount. By setting goals, you can see how well you’ve followed your plan.

Look for tax breaks

In an interview with The New York Times3, Lewis Altfest, CEO of Altfest Personal Wealth Management, said he often recommends deferred revenue instruments to his high-income clients—many of whom are physicians—as a way to lower their current tax bill.

Some physicians defer as much as $150,000 a year, using a combination of instruments including, but not limited to, 401(k), retirement accounts and brokerage accounts.

Your financial advisor will be able to tailor a tax strategy that works for you. Don’t put this off. The longer you wait, the more of your hard-earned income you’ll pay in taxes. At this time, you may also want to consider protecting your income with AAFP Association Group Disability Income Insurance. If you pay premiums from your personal funds, these benefits may be tax-free.

And while we’re on the subject of taxes, we have an oldie but a goodie in our blog from 2012: Ten Tips to Lower Your Tax-Audit Profile.

Staying fresh

To meet their financial responsibilities, many young physicians turn to overtime. While it’s important to earn the money you need to manage your debts, it’s equally important to find a work-life balance that steers you from burnout.

That’s a real concern for family physicians. According to a recent survey of over 15,000 physicians in more than 25 specialties, Family Medicine is one of the top 5 affected by burnout.5 Strive for a healthy work-life balance that gives you time to relax and enjoy time with your loved ones.

1 Medscape · Physician Debt and Net Worth Report 2016

2 AAMC · Medical Student Education: Debt, Costs, and Loan Repayment Fact Card

3 Facts About Life 2016, LIMRA