While certainly provocative, the question deserves an answer. It depends on how well you prepare for:

- The financial burden of student loans.

- The extra decade of education and training necessary, which keeps you out of the job market when your peers are earning money.

- The fact that not all fields of medicine are equally well compensated, making it harder for some to keep up with loan payments, cost-of-living increases and saving for retirement.

Below are some strategies for gaining financial freedom that will lift some of the pressures and make practicing medicine more satisfying and rewarding.

What is financial freedom?

To find financial freedom, you need to look inward because the answer is different for everyone. Financial freedom is what you feel you and your family will need to be secure and have the financial independence to do what you want.

Your definition of financial freedom may be to retire early and teach or volunteer your services. Or it could be to work as long as possible and enjoy a high-energy lifestyle of travel, extended vacations, and expensive toys. Or perhaps you just want to retire at 65 to enjoy the simple pleasures of family, friends and home. Whatever it is, you need to start planning now. That’s because even if you plan to retire at 65, you should be saving 15 to 20% of your income throughout your working years.

This guide focuses on helping you:

- Start right by managing debt and developing solid financial habits.

- Manage your money during your most productive, income-producing years.

- Plan for retirement.

- Protect against financial risks.

Know Your Goals So You Can Prioritize

You can’t build a financial plan without a sense of where you want to go. Be honest: How soon do you want your student debt paid off? Do you want to live debt-free? What do you want your retirement to look like? Are you committed to paying for your children’s education and leaving a legacy?

While these are life-changing questions, you need to be strategic and prioritize before you start committing to significant expenses, such as getting married, buying a house and having children.

You may decide that paying your student loans needs to be your first priority, followed by buying a home. Always deal with your highest interest debts first, either by paying them off or refinancing at a more favorable rate.

Next, review your spending habits and determine if they align with your goals. Once you understand your expenses, you can better prioritize, cutting back on and eliminating some costs.

As you begin to deal with debt, build financial self-discipline and become serious about your financial planning, you’ll discover greater peace of mind.

Set a Realistic Budget You Can Live By

Budgeting will help you remain on track with your goals and keep you off the treadmill of almost unconsciously growing into your income to keep up with the Joneses.

Start with the basics: Food, housing, and transportation should take up no more than half of your income. Then, allocate a percentage for paying down debt, and try to put aside 10 to 15% for savings and emergencies.

Finally, start saving for retirement. Early investing in an IRA, Roth IRA or 401(k) allows you to take advantage of the power of compounding. Let’s see how that works.

In this example, three doctors invest the same amount of money ($1,000 a month for ten years) and receive the same interest (7%) on their investment. The difference is the age when they began to invest and, thus, the number of years that their money can compound.

Dr. Smart started at age 25, Dr. Dawdle waited until age 35 and Dr. Uphill didn’t get around to investing until he was 45.

In each case, the $120,000 compounded and grew until age 65. At that time, Dr. Smart’s investment had grown to $1,444,969. Dr. Dawdle had $734,549. But poor Dr. Uphill’s nest egg was just $373,407. That’s the power of compounding. Let your money work for you!

Have a Strategic Plan for Investing and Stick to It

Income—even a good income—is not the same as wealth. That comes with the addition of passive income and prudent investment in a range of asset classes that match your income and risk tolerance. Asset classes include stocks, bonds, real estate, precious metals and more.

It’s essential to work with a financial professional to build a strategic plan for a balanced and diversified portfolio based on your financial objectives and ability to manage risk. Key to your success is to follow your plan and resist the temptation to chase performance, time your investments or react emotionally to short-term market upswings and downturns.

The primary reasons for investor missteps are fears of losing money, desires to follow the crowd, eternal optimism, regrets over past failures and losses and efforts to justify a decision. When you allow emotional drivers to influence your actions, losses are likely to follow.

Manage Your Taxes

Doctors are generally in the highest income tax bracket. And while tax avoidance shouldn’t drive your earning and investment decisions, you can include tax-mitigation and -reduction strategies that are more advantageous to you.

Work with a tax professional to reduce taxable income. You’ll want to discuss the pros and cons of pre-tax versus post-tax contributions to your retirement plan (e.g., 401(k), 403(b), 457 or Roth IRA).

If you are self-employed, itemize deductions for continuing education, computers and office equipment and business-driven expenses. If you’re not self-employed but are receiving income outside your salary for teaching, research or contractor services, ask a tax accountant for advice on setting up an LLC or sole proprietorship and deduct your business expenses.

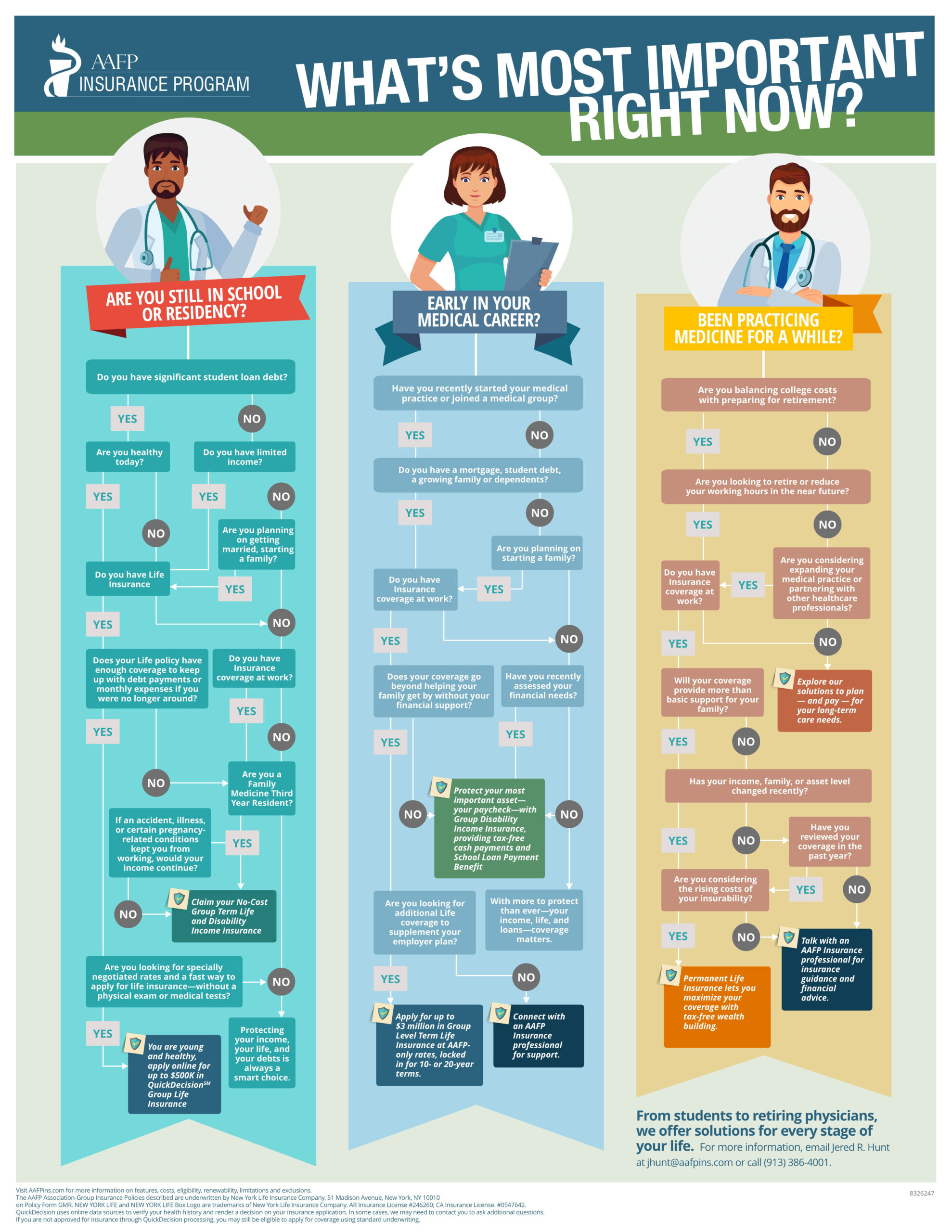

Insure Against Financial Risks

As your income increases and your savings and assets grow, asset protection becomes a priority. Also, physicians have a few unique financial risks to consider.

In addition to carrying enough personal liability and life insurance, you need malpractice liability protection. You can also talk with your spouse, attorney and a financial planner on the best way to structure your estate.

And what if you can’t work? While no one wants to consider the possibility of an injury or health crisis that prevents you from practicing medicine, it can happen. One in three doctors will suffer a disability during their career, and there’s a 40% chance it will last for seven years or longer. Disability insurance can protect you and your family.

Plan now to protect your financial freedom and achieve your retirement plans.