The median debt incurred for medical education is $180,000.[i] And that’s not all. The median figure for pre-medical education debt is $25,000. Plus, on average, post-grads have $4,000 in credit card bills and $12,000 in residency/relocation loans.[ii]

That’s a total of $221,000 of indebtedness before a doctor’s first day of work. For comparison, the median home value in the U.S. is $198,000[iii]. It follows that your debt burden is likely greater than most families’ mortgages.

Clearly, you’ve made a significant investment in your education and you’re banking on a healthy income to make your payments affordable. What happens, however, if your income is disrupted?

Debt After Death

After Lisa Mason, a critical care nurse died of liver failure at the age of 27, her parents struggled to pay around $100,000 of her student loan debt. With late penalties and interest, it rapidly ballooned to over $200,000. On top of their overwhelming grief at the loss of their daughter, the financial burden was devastating.

Have you ever considered, what would happen to your debts if you died unexpectedly? Would your loved ones have to pay them?

The answer depends on whether anyone co-signed your loans, the type of loans you have and the state where you live.

There are financial risks related to some private student loans if the borrower dies. While some forgive a loan, most do not. So what happens if your loans are from a private lender that’s less than forgiving if death interrupts payments?

First, the lender will attempt to collect the funds from your estate. If that adds up to less than your outstanding loans, they will move on to a co-signer if one exists.

If a parent or spouse co-signed your loan, they are now on the hook to pay it back. If the co-signer does not pay the private lender, and you took out the loan while married and you lived in a community property state, they will expect your spouse to pay. Community property states include Arizona, New Mexico, Texas, Washington and Wisconsin.[iv]

Federal student loans work differently. While they usually do not require a co-signer, those that do (Parent PLUS loans) are forgiven if the borrower passes away. That’s because all debt from federal student loans is erased in the event of a student’s demise.

Better Safe than Sorry

Should you pass on, your family may not have the ability to pay off your loans. To make it worse, it will be difficult if not impossible for them to use bankruptcy to discharge your loans.[v]

So if you are looking for a little peace of mind that you will not leave loved ones to face financial struggles, it is best to protect them. How? With a life insurance policy.

You may feel that you are too young to purchase life insurance. Consider, however, that the insurance company will consider your age in their risk assessment, so you will receive a lower price on any plan you buy.

Perhaps you do not think you need life insurance because you are not yet married. You may need it, however, if your parents cosigned your loan.

If you now understand the rationale for buying life insurance, you are likely wondering how much of a bite it will take out of your paycheck. It is probably less than you think.

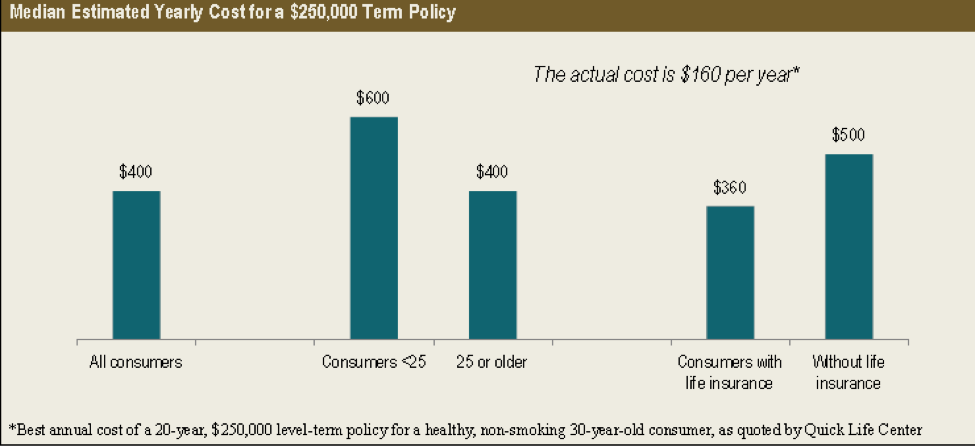

Millennials overestimate the cost of life insurance by 213 percent. Gen Xers do not fare much better with the estimating skills — they overprice it by 119 percent.[vi]

The lowest cost for a 20-year, $250,000 term life insurance policy for a healthy, non-smoking 30-year-old in 2015 was $160 a year — not much compared to the peace of mind it could provide.

Source: Life Happens

The Ball Is in Your Court

Every day you make decisions that affect the health and lives of your patients. Now it is time to make one that directly impacts your spouse, parents or anyone else who has been behind you as you acquired your education. After all, you do not want to burden your most avid supporters with debts that likely run into the six figures.

A little insurance can go a long way to making sure your family will be financially secure even if the worst happens.

[i] Association of American Medical Colleges – Medical Student Education: Debt, Costs and Loan repayment Fact Card 2016

[ii] Association of American Medical Colleges – Medical Student Education: Debt, Costs and Loan repayment Fact Card 2016

[iii] Zillow – United States Home Prices and Values

[iv] Student Loan Hero – This Is What Happens to Your Student Loans When You Die

[v] Student Loan Borrower Assistance – Bankruptcy

[vi] Life Happens – 2015 Insurance Barometer Study